nc state sales tax on food

The latest sales tax rates for cities in North Carolina NC state. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

North Carolina Sales Tax Update

Lowest sales tax 675 Highest sales tax 75 North Carolina Sales Tax.

. Prescription Drugs are exempt from the North Carolina sales tax. NC State is not exempt from the prepared food and beverage taxes administered by local counties and. Maximum Possible Sales Tax.

The exemption only applies to sales tax on food purchases. Aircraft and Qualified Jet Engines. 75 Sales and Use Tax Chart.

Prescription Drugs are exempt from the North Carolina sales tax. North Carolinas general state sales tax rate is 475 percent. What is the NC income tax rate for 2020.

County and local taxes in most. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Historical Total General State Local and Transit Sales and.

Total General State Local and Transit Rates Tax Rates Effective 1012020 Historical Total General State. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food. Maximum Local Sales Tax.

2020 rates included for use while preparing your income tax. Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC.

The North Carolina NC state sales tax rate is currently 475. Rates include state county and city taxes. 2022 List of North Carolina Local Sales Tax Rates.

This tax is in addition to State and local sales tax. North Carolina State Sales Tax. Average Sales Tax With Local.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main content Menu. The tax amount is a mathematical computation of the.

7 Sales and Use Tax Chart. Dry Cleaners Laundries Apparel and. Showing 1 to 6 of 6 entries.

This page describes the. Items subject to the general rate are also subject. 2 Food Sales and Use Tax Chart.

Gross receipts derived from sales of food non-qualifying food and. Average Local State Sales Tax. Depending on local municipalities the total tax rate can be as high as 75.

725 Sales and Use Tax Chart. General Sales and Use Tax. A customer buys a toothbrush a bag of candy and a loaf of bread.

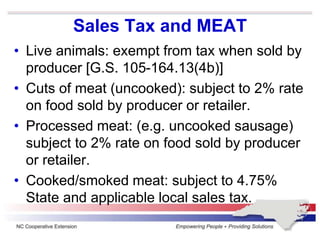

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Aviation Gasoline and Jet Fuel. The sales tax rate on food is 2.

For Tax Years 2019 and 2020 the North Carolina individual income tax rate is. 475 State rate plus applicable local rates sales.

Articles Of Sales Tax Distribution Nc Department Of Revenue

Understanding California S Sales Tax

These Are Other States With Tax Breaks On Diapers And Menstrual Products Fortune

Cottage Food Sales Tax Understanding The Basics Castiron

States Have Historic Amounts Of Leftover Cash The Economist

General Sales Taxes And Gross Receipts Taxes Urban Institute

What Is Sales Tax Nexus Learn All About Nexus

Sales Tax Laws By State Ultimate Guide For Business Owners

Everything You Need To Know About Restaurant Taxes

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

North Carolina Sales Tax Small Business Guide Truic

Taxes On Food And Groceries Community Tax

Is Food Taxable In North Carolina Taxjar

States Without Sales Tax Article

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States With The Highest Lowest Tax Rates

![]()

Prepared Food Beverage Tax Wake County Government

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com